The UK Property Market in 2025: Prices

The UK property market in 2025 is showing signs of change. After years of sharp rises, growth has slowed, and buyers and sellers are adjusting to new conditions.

September 14, 2025 09:40

Whether you’re looking to buy your first home, invest in property, or sell, understanding current prices and trends is key.

Average House Prices in the UK

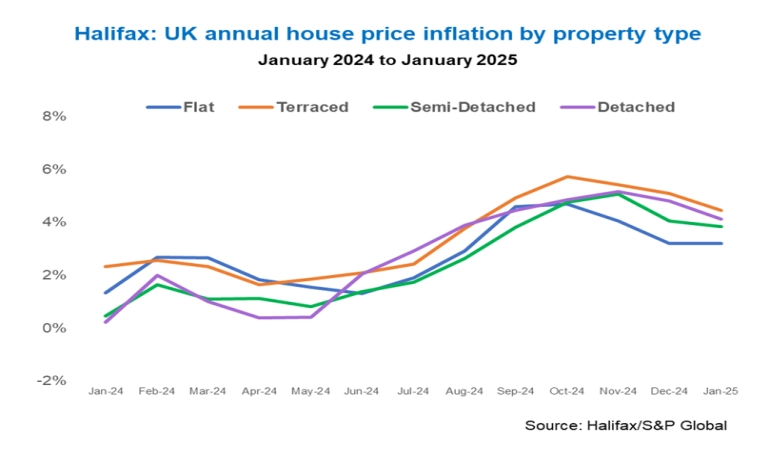

As of late 2024, the average UK house price was around £292,000, reflecting annual growth of just over 3%. While that’s still an increase, it’s slower compared to the rapid rises seen in previous years.

London remains the most expensive region, with average prices often above £500,000.

South East and South West England sit in the middle, with typical values between £300,000–£350,000.

Northern England, Wales, and Scotland remain more affordable, with some areas averaging under £200,000.

What’s Driving the Market?

Several key factors shape today’s property market:

Interest rates & mortgages – Higher borrowing costs have cooled demand, though mortgage rates are starting to ease.

More homes on the market – Rising stock levels give buyers more choice, reducing competition.

Changing lifestyle needs – Remote working means many families are moving outside of city centres in search of space.

Government policy – Stamp duty rules, landlord regulations, and potential tax changes continue to affect buyers and investors.

Regional Property Trends

London: Prices remain high, but growth has slowed. Some areas are even seeing small declines.

South & East of England: Still popular for commuters and families, with steady but moderate growth.

The North, Wales, and Northern Ireland: Stronger growth rates thanks to lower entry prices and rising demand from first-time buyers.

Opportunities and Challenges

For buyers: There’s more choice on the market, but affordability is still tough, especially in the South.

For sellers: Realistic pricing is key. Homes that are overpriced are sitting on the market longer.

For investors: Buy-to-let remains attractive in some regions, especially where rental demand is strong, though regulation is tightening.

The look for 2025 and beyond

Looking ahead, the market is expected to remain stable with modest growth. If interest rates drop further, affordability will improve, encouraging more activity. Regions outside London may continue to see stronger growth, especially in areas with new infrastructure, transport links, and affordable housing options.

The UK property market in 2025 is more balanced than in recent years. For buyers, this could mean better opportunities. For sellers, it’s a time to be competitive and realistic.